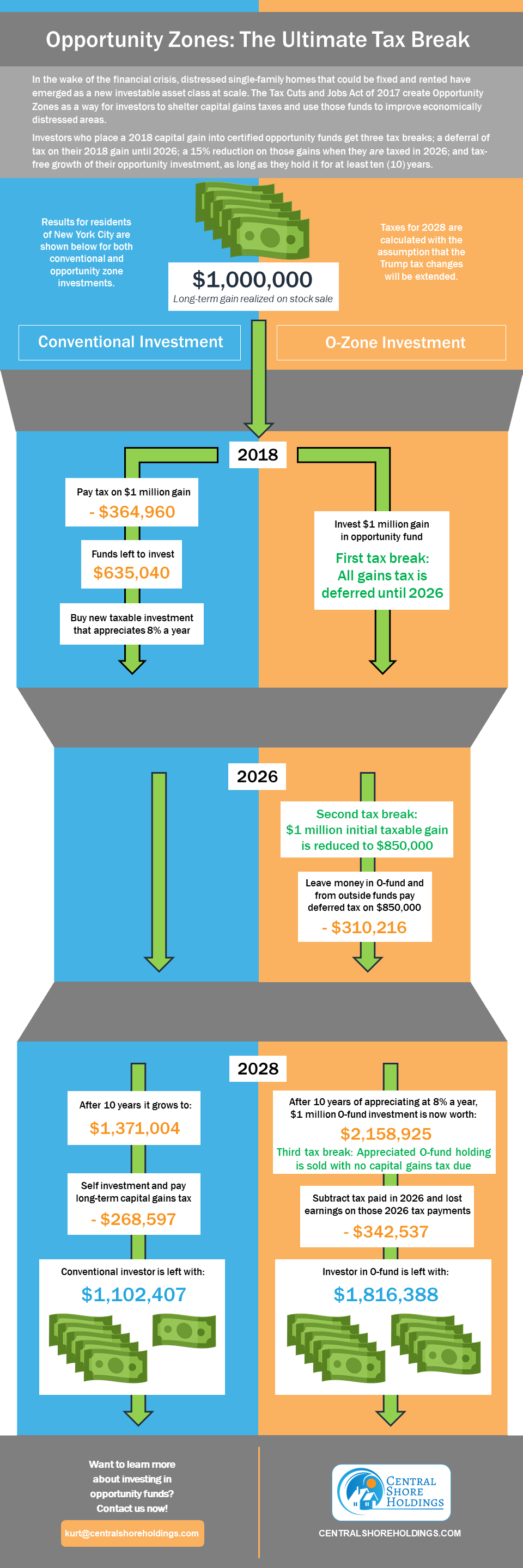

An infographic explaining the financial differences between conventional investments and opportunity zone investments.

Qualified Opportunity Zones

In the wake of the financial crisis, distressed single-family homes that could be fixed and rented have emerged as a new investable asset class at scale. The Tax Cuts and Jobs Act of 2017 create Opportunity Zones as a way for investors to shelter capital gains taxes and use those funds to improve economically distressed areas.

Investors who place a 2018 capital gain into certified opportunity funds get three tax breaks:

A deferral of tax on their 2018 gain until 2026

A 15% reduction on those gains when they are taxed in 2026

Tax-free growth of their opportunity investment, as long as they hold it for at least ten (10) years.

Central Shore Holdings LLC is currently buying and renting homes in tax-advantaged Qualified Opportunity Zones in New Jersey.

For a list of Qualified Opportunity Zones, and a map of the areas, you can check out the U.S. Department of the Treasury’s Community Development Financial Institutions Fund website. The IRS also answers many Frequently Asked Questions about Opportunity Zones on their website.